This article covers carrier scorecarding and the following topics:

Why carrier scorecarding and performance measurement matter

The challenges and pitfalls of performance measurement and carrier scorecarding

Scorecard KPIs that shippers and carriers need to align on

Standardization of carrier KPIs across the industry

The value of a universal scorecard

Carrier scorecarding is the foundation for supply chain performance measurement. Scorecards offer shippers a way to objectively analyze carriers through KPIs so they can track performance related to On-Time Delivery (OTD), On-Time Invoicing (OTI) and Payment, responsiveness, data governance, among other metrics.

Scorecards help shippers make data-driven decisions that lower risk when procuring transportation, identifying internal bottlenecks, and navigating complex customer SLA programs. Scorecards also help carriers differentiate themselves and identify opportunities for improvement. An effective carrier scorecard workflow increases visibility into performance, saves costs, reduces the risk of penalty exposure, and provides accurate, timely data needed to make informed decisions.

However, there are limitations to the current scorecarding process. As of today, scorecarding is a manual, time-consuming, error-prone task that varies from partner to partner. It often requires shippers and carriers to sift through various spreadsheets from siloed systems and attempt to create a cohesive narrative of what happened during a shipment.

When done correctly, carrier scorecards improve trust between supply chain partners, resulting in a more productive, efficient, and effective supply chain.

Why carrier scorecarding and performance measurement matter

Performance measurement is the backbone for creating strategic shipper and carrier relationships. By accurately measuring and sharing performance, supply chain partners have an easier time building trust and optimizing their relationships for both service and price. Without trust, productivity is lost and efficiency and effectiveness suffer.

There are significant advantages to using a carrier scorecard to measure performance. It:

Strengthens relationships: Scorecards helps shippers define the strengths and weaknesses of carriers within their network. That information can then be relayed back to the carrier so they can improve.

Balances cost vs. service: Scorecards help procurement teams answer important questions like: “Is it worth it to spend additional money to improve performance into Walmart?”, or “How much are rejected tenders or late shipments costing?”, or “Who are the best carriers delivering into Target?”.

Increases ROI: Carrier scorecards help shippers identify which carriers perform well in what areas, helping shippers more effectively award freight across their network.

Makes supply chains more resilient: Carrier scorecards help shippers be better prepared to determine which carriers are best equipped to meet their needs during uncertain times.

Improves performance visibility: Using scorecards, carriers/shippers can drill down into the weeds of performance, opening up newfound insights that can propel the business forward.

Without measuring performance, creating value-added activities with partners becomes almost impossible and the supply chain tools used to improve efficiency, effectiveness, and productivity are ineffective.

Steven Prince of Inbound Logistics states: “While transportation service providers vary in size and ability, having an overall strategy to track carrier performance can drive long-term operational and financial stability. By relying on simple data captured over time, over-the-road shippers are better positioned to make informed decisions on the fly or in future bids to ensure their desired mix of cost, coverage, and performance.”

The challenges and pitfalls of performance measurement and carrier scorecarding

Today’s scorecarding process is very manual, time-consuming, and error-prone, making it difficult to accurately measure performance and execute timely decisions. Important information is stored in multiple systems of record (i.e. transportation management system), and documentation is scattered across email chains and spreadsheets. This makes it challenging to collaborate across stakeholders in real-time and nearly impossible to identify responsible parties or the monetary impact of a service failure.

The underlying problem with scorecarding and performance measurement is poor data quality within a shipper’s/carrier’s TMS, ERP, and homegrown systems. Data reconciliation is a major challenge for supply chain partners where some companies dedicate nearly 100 hours a week to data collection, cleaning, and distribution, often resulting in incomplete or inaccurate datasets. With erroneous data fueling carrier scorecards, shippers struggle to form a narrative around what carriers are performing well and why. Additionally, this untrustworthy data is used for QBR discussions, procurement decisions, and root cause analysis, resulting in billions of lost dollars from erroneous retailer chargebacks, suboptimal routing guide decisions, and inefficient discussions with business partners.

Scorecard KPIs that shippers and carriers need to align on

Across the industry, there are certain Key Performance Indicators (KPIs) that supply chain partners should track in order to get a sense of the service that carriers provide. Below are the top 5 metrics that when not tracked properly, have significant ramifications that impact the bottom line, service, and reputation.

On-time delivery (OTD)

Nearly every company is bound to delivery times and delivering a shipment on time is a clear sign of a reputable carrier. Early and late deliveries can result in hefty penalties and fines, alienated customers, and lost shelf space. Improving OTD service can lead to increased volume in the future, and poor service can lead to lower volume.

By monitoring and tracking on-time performance metrics, shippers will be able to do a detailed analysis of their carrier network and identify top performers in terms of timeliness and accuracy. On the other hand, carriers will be able to identify where they’re underperforming and how to correct the issue.

On-time pickup (OTP)

OTP is another key KPI that shippers and carriers should track. If a carrier is late for a pickup then the shipment is delayed, an opportunity for a sale is lost, and it can be expensive to reschedule.

By tracking this metric, shippers can drill down into their data and better determine what date, time, and location a specific carrier has a poor OTP rate.

OTD Required Delivery Date (RDD)

On-time Delivery RDD refers to how often the carrier arrives on time for the required delivery date. This date is set by retailers for when they would like an order delivered. This required delivery date could be different from the scheduled delivery date, so it is possible for a carrier to be on time to the appointment and late to RDD, or on time to the RDD and late to the appointment. The idea is to measure how often orders are arriving on the day requested by the retailer.

Tender acceptance/rejection rate

Tender rejections are often a leading indicator of spot rates as well as contract rates. Tracking tender rejections over time can tell shippers if the industry is in a loose, balanced, or tight trucking market.

MIT student, Yoo Joon Kim found that, when a truckload shipment is rejected, the price increases by an average of 14.8%. The increase is due to shippers having to utilize the spot market to move goods, which can be more volatile. If shippers are able to identify ways to lower their rejection rate, they can lower costs.

Missed pickup

When pickups are missed, carriers and shippers both suffer. Shippers can’t move their freight, the carrier has to try again another day, and depending on the broker, there’s a lot of back-end work to fix the issue. By tracking a missed pickup, shippers can better determine which party was at fault and why.

Other useful KPIs include: billing accuracy, damaged shipments, and carrier load preference (i.e. LTL)

Standardization of carrier KPIs across the industry

One of the biggest challenges with performance measurement and scorecarding is that each shipper/carrier/retailer defines their KPIs differently. The requirements for a successful OTD are often vastly different from shipper to shipper and retailer to retailer. Some shippers allow for a 30-minute buffer to deliver goods, while others simply look to ensure their product was delivered on the Requested Delivery Date. Because each shipper defines OTD differently, it becomes very difficult to benchmark and compare performance related to that KPI.

The need for standardization in the industry is felt by shippers and carriers of all sizes. It allows for the creation of benchmarks by which shippers, carriers and LSPs can fairly measure themselves against competition and secure new business. Many companies want to pay lower costs for transportation, but because they aren’t able to truly measure performance (or the impact of performance), they end up choosing the cheapest option with unreliable service because they can’t justify paying more. Consequently, shippers open themselves up to more risk and penalty exposure which can cost them more in the long run.

The foundation for effective performance measurement is data transparency and quality. According to Will Kerr, CEO of Edge Logistics, “If we have that, then we can secure more stable capacity. We could avoid a lot of inefficiencies in the market that cost all of us a lot. It will allow us to do things faster and more accurately, meaning we can do them more cost-effectively.” Read more here.

The value of a universal scorecard

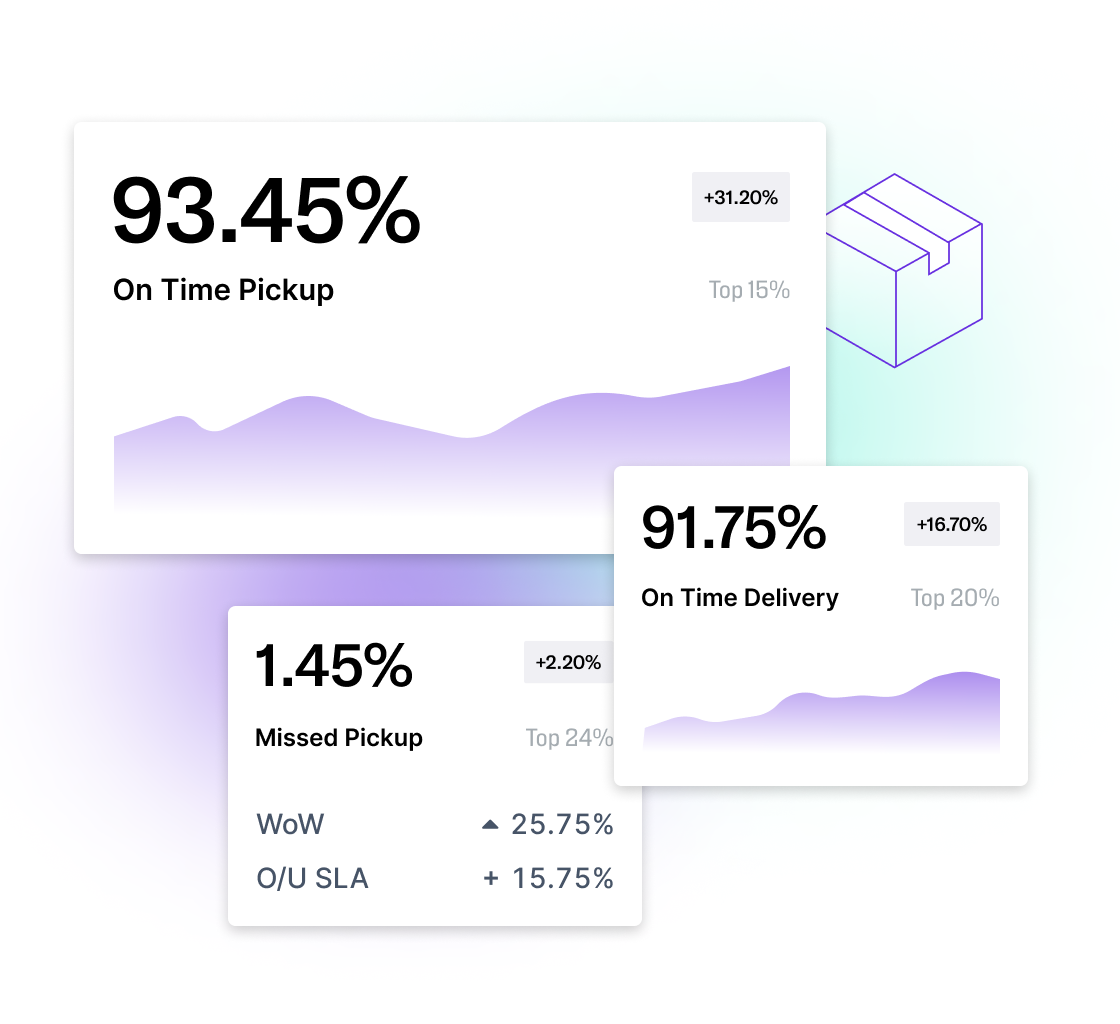

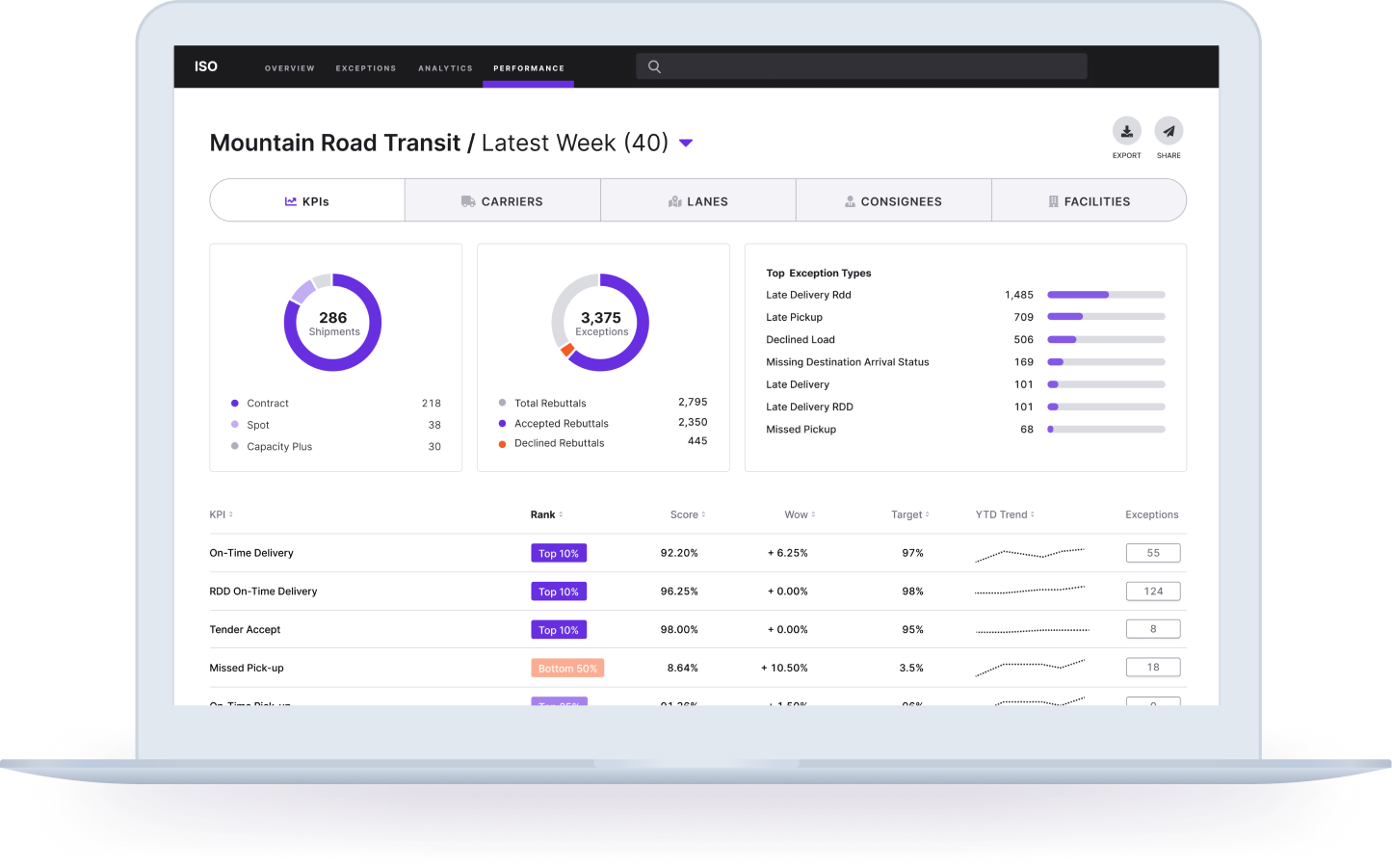

A universal scorecard is defined as a central, unified experience where shippers and carriers can drill down to find any and all cuts of data they need to understand and optimize their business.

By adopting a universal scorecard, shippers/carriers can shift their focus from thinking about scorecarding as a weekly, static report to thinking about scorecards as an ongoing performance management hub, where they can constantly find opportunities for improvement and measure their performance over time.

With scorecarding information easily accessible and all under one hood, shippers and carriers can collaborate and surface insights quicker so they can resolve issues and provide better service.

Where to go from here

It’s clear that carrier scorecards and performance measurement, as a whole, are key aspects of building strategic, long-lasting relationships and strengthening supply chains. Scorecards allow shippers and carriers to surface actionable insights that optimize relationships. However, as outlined above, tracking and measuring performance in a timely, accurate manner is not easy. There’s a massive data accuracy problem that causes mistrust and excess manual work within the industry. Because of that, carriers and shippers are unable to form a coherent narrative as to who was at fault for a service failure, why, and the monetary impact of that failure.

The future of scorecarding needs to evolve from manual, offline processes to dynamic performance management. Shippers and carriers need a standardized, single source of truth to collaborate on performance data. This data should be centralized, searchable, and validated by all parties, which ultimately will serve to foster trust and optimize complex business partnerships.