Amazon Prime’s rise has had a domino effect throughout the industry, forcing retailers across markets and verticals to fall back on vendor compliance programs in order to keep their shelves stocked. This in turn has increased the pressure on shippers to achieve almost perfect performance levels. As consumer demand fluctuates in general, their expectations for customer service and product availability remain as stringent as ever. The tried-and-true methods of matching carriers to loads no longer suffice.

Navigating this new normal requires a deep understanding of your transportation network and the ability to leverage service-level performance data for critical decision-making. Despite this, a report indicates that only 6% of North American supply chain and logistics companies have adequate visibility into their supply chain performance.

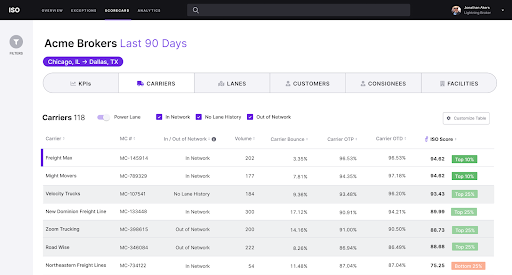

This article delves into how shippers and logistics service providers can embrace collaborative, data-driven logistics through innovative solutions like ISO’s Dynamic Carrier Scorecards.

The Drawbacks of Traditional Scorecards

The limitations of conventional scorecard processes are becoming increasingly apparent in today’s rapidly evolving freight landscape. Traditional scorecards, often tailored to each shipper, are plagued by limitations that compromise their effectiveness:

- Static data – Traditional scorecards are often shared weekly or monthly in the form of an excel spreadsheet or BI dashboard. They represent a snapshot in time for a carrier or broker, and are not inherently dynamic or responsive to carrier feedback. Even when carriers and shippers revise the data in a business review, the TMS data is never updated to reflect the truth.

- Inadequate collaboration and transparency – Traditional scorecards lead to a he-said-she-said type dynamic between shippers and service providers. A shipper shares a static report with a carrier at the last minute, who then scrambles to understand the discrepancies with their own data in their own TMS. They don’t have an opportunity to collaborate or contextualize what happened with each load.

- Absence of shared source of truth – Without a shared source of truth that both shippers and their partners can access 24/7, proactive Quality Business Reviews (QBRs) are hindered, limiting carriers’ ability to address concerns with accurate, mutually agreed-upon data.

The shortcomings of traditional scorecards are clear. Limited access, a lack of alignment on the data, and the absence of industry benchmarks all contribute to an inaccurate assessment and lack of context surrounding carrier performance. The freight industry needs an innovative solution that breaks free from the constraints of these outdated scorecards.

The Importance of Performance-Based Carrier Evaluation

Performance metrics should increasingly guide shippers and brokers in carrier selection as retailers ramp up vendor compliance programs and fines. Today, industry giants like Walmart and Target will fine their suppliers a percentage of the total order value of a shipment for poor service as part of ever-expanding vendor compliance and OTIF programs. Customers demand excellence, which trickles down from shippers to carriers, putting them under similar scrutiny to deliver precisely that.

But without an understanding of the total cost of ownership, how do you know when it is work paying up for better service? Will you even get what you paid for?

How do you know whether a new low-cost provider will actually result in lower service levels?

With traditional performance measurement methods, which hinge on siloed TMS data without context or documentation, the truth behind the history of each shipment is missed. Delving into root causes of service issues or the total cost of transportation procurement is impossible. Relying on availability and rates for carrier evaluation is inadequate, and the data behind the static carrier scorecards of yesterday is too flawed to fill the gap.

Unlocking Dynamic Scorecards’ Transformative Power

ISO’s dynamic carrier scorecards offer several advantages over the performance management processes of yesterday:

- Expansive KPIs and metrics – ISO’s scoring system encompasses a multitude of metrics, with more than 100 KPIs available out of the box, creating a comprehensive view of carrier performance. It goes beyond capacity and rates, further eliminating the risk of working with a given carrier.

- Industry benchmarking – ISO measures carrier performance for each shipper or broker in the network, and provides industry-wide benchmarking for several KPIs.

- Transparency and collaboration – Carriers have a chance to review performance exceptions and help resolve data discrepancies, and have 24/7 access to the resulting scorecards. This results in a shared understanding of what needs to improve well before any business review becomes necessary.

- No more “tribal knowledge” – ISO scorecards for brokers provide operators with impartial, networked data, reducing subjectivity or tribal knowledge in carrier selection. It establishes a realm where carrier decisions are rooted in factual insights.

- Mapped to retailer SLAs – ISO scorecards for shippers are mapped to customer SLAs, so both shippers and carriers are measuring performance with the end customer’s policies in mind.

- Mitigating operational risk – A detailed grasp of carrier performance strengths and weaknesses guides decisions away from pitfalls like delays or overruns, mitigating risk beyond simple paper rates.

Four ways for brokers to leverage ISO Scorecards and select better carriers

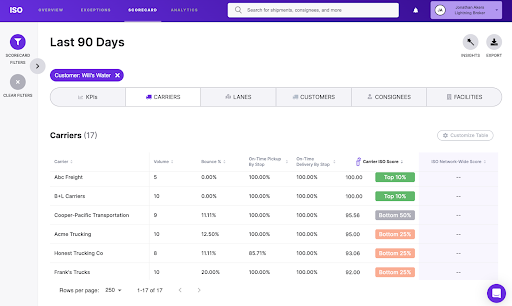

Find (and KNOW) the top performers for your biggest customers

Head to the customer tab, see your top customers by volume, filter for any specific customer, head to carrier tab and sort by the KPI you care about. Make note of the top performers (and the bottom performers) and circulate that intel to your customer facing teams so they can let your biggest customers know the plan.

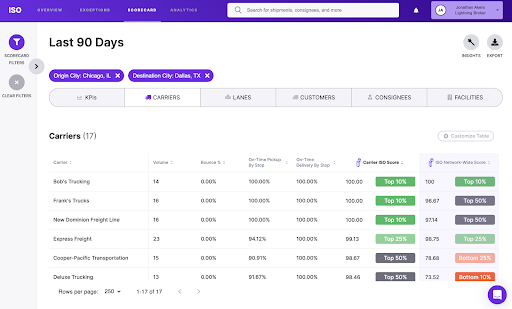

Filter by your most common lanes and stack-rank your carriers

The lanes report gives you a breakdown of top lanes by volume, as well as the ability to stack rank your lanes for specific performance KPIs. Find a problematic lane with high volume and apply a filter, then head to the carrier tab to see which carriers deserve a second look based on how they service that lane.

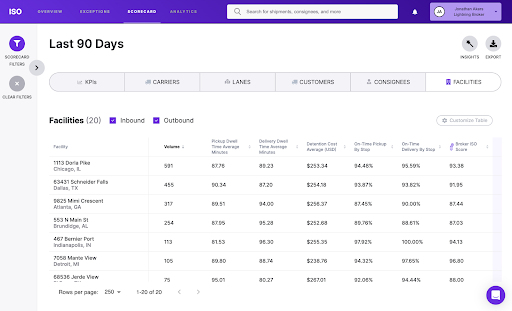

Track performance into specific facilities

The facilities tab in ISO breaks down your network performance into specific facilities. If you have a big regional customer that is demanding high performance in their center, find it in the facilities tab and check out recent performance against their KPIs. You can filter for that facility and understand your penalty exposure, and who is responsible on the KPI overview tab.

From here, check out the carriers that are leading to more exposure by filtering for carriers under the responsible party, then head to the carriers’ tab to see those carriers stack ranked. This will help you understand who you shouldn’t work with when it comes to a given facility.

See the top performers that aren’t yet in your network

ISO Scorecards for brokers feature the ability to search by lane, and see top performing carriers that service it. This applies to carriers you work with today as well as all carriers that service that lane in the ISO network.

Shippers have the ability to find top performing brokerages for key lanes as well. This allows everyone to onboard new partners without the risk of unknown performance history.

Embracing Evolution with ISO’s Scorcarding For Optimal Carrier Selection

Traditional scorecards fall short in an environment where every moment counts and precision is paramount. ISO‘s dynamic, collaborative, and data-rich approach emerges as a beacon of transformative change. Shippers and brokers must step beyond tradition and adopt ISO’s system for enhanced efficiency, transparency, and data-driven carrier partnerships to excel in this dynamic North American freight era.

Lead the Way: Embrace ISO’s Paradigm Shift for Unparalleled Carrier Selection and Management. Learn more about dynamic scorecarding and book a demo today.